Account: R0223695

July 4, 2025

| Account | Parcel | Account Type | Tax Year | Buildings | Actual Value | Local Govt Assessed Value | School Assessed Value |

|---|---|---|---|---|---|---|---|

| R0223695 | 070736311001 | Residential | 2025 | 1 | 478,081 | 29,880 | 33,700 |

| Legal |

|---|

| ETN CC-1 L1 CENTENNIAL COMMONS |

| Subdivision | Block | Lot | Land Economic Area |

|---|---|---|---|

| WELD COUNTY | 1 | CENTENNIAL PATIO |

| Property Address | Property City | Section | Township | Range |

|---|---|---|---|---|

| 50 CHERRY AVE 1 | EATON | 36 | 07 | 66 |

| Account | Parcel | Account Type | Tax Year | Buildings | Actual Value | Local Govt Assessed Value | School Assessed Value |

|---|---|---|---|---|---|---|---|

| R0223695 | 070736311001 | Residential | 2025 | 1 | 478,081 | 29,880 | 33,700 |

| Account | Owner Name | Address |

|---|---|---|

| R0223695 | VARNER NANCY LETSON | 50 CHERRY AVE UNIT 1 EATON, CO 806153681 |

| R0223695 | VARNER LEO BENTLEY |

| Account | Parcel | Account Type | Tax Year | Buildings | Actual Value | Local Govt Assessed Value | School Assessed Value |

|---|---|---|---|---|---|---|---|

| R0223695 | 070736311001 | Residential | 2025 | 1 | 478,081 | 29,880 | 33,700 |

| Reception | Rec Date | Type | Grantor | Grantee | Doc Fee | Sale Date | Sale Price |

|---|---|---|---|---|---|---|---|

| 2403006 | NA | SUB | SUBDIVISION | CENTENNIAL COMMONS B7 CENTENNIAL | 0.00 | NA | 0 |

| 2444394 | 06-28-1995 | WD | NOFFSINGER MANUFACTURING CO IN | TRI-TREND INC | 2.00 | 06-28-1995 | 20,000 |

| 2485866 | 04-15-1996 | WD | TRI-TREND INC | AUGUST JOSEPH E & MARILYN B | 16.51 | 04-12-1996 | 165,100 |

| 2725456 | 10-07-1999 | WD | AUGUST JOSEPH E & MARILYN B | BARNES DAVID R & REBECCA S | 17.99 | 10-01-1999 | 179,900 |

| 3097013 | 08-19-2003 | WD | BARNES DAVID R & REBECCA S | HOYT KENNA | 23.50 | 08-15-2003 | 235,000 |

| 3242116 | 12-07-2004 | WD | HOYT KENNA | GOODELL GEORGE | 23.50 | 12-07-2004 | 235,000 |

| 3899651 | 01-02-2013 | WDE | GOODELL GEORGE | VARNER NANCY LETSON | 20.00 | 12-27-2012 | 200,000 |

*If the hyperlink for the reception number does not work, try a manual search in the Clerk and Recorder records. Use the Grantor or Grantee in your search.

| Account | Parcel | Account Type | Tax Year | Buildings | Actual Value | Local Govt Assessed Value | School Assessed Value |

|---|---|---|---|---|---|---|---|

| R0223695 | 070736311001 | Residential | 2025 | 1 | 478,081 | 29,880 | 33,700 |

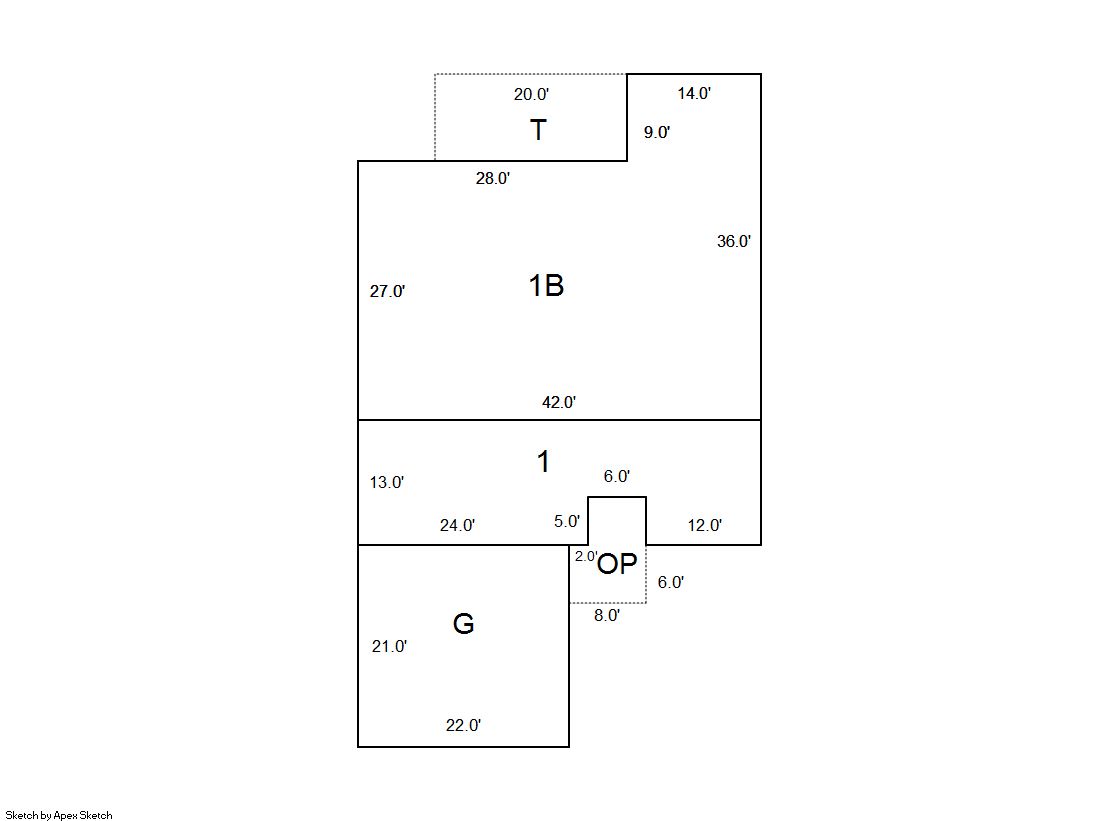

Building 1

| AccountNo | Building ID | Occupancy |

|---|---|---|

| R0223695 | 1 | Single Family Residential |

| ID | Type | NBHD | Occupancy | % Complete | Bedrooms | Baths |

|---|---|---|---|---|---|---|

| 1 | Residential | 9E2010 | Single Family Residential | 100 | 4 | 3.00 |

| ID | Exterior | Roof Cover | Interior | HVAC | Perimeter | Units | Unit Type | Make |

|---|---|---|---|---|---|---|---|---|

| 1 | Frame Masonry Veneer | Composition Shingle | Drywall | Central Air to Air | 0 | 0 | NA | NA |

| ID | Square Ft | Condo SF | Total Basement SF | Finished Basement SF | Garage SF | Carport SF | Balcony SF | Porch SF |

|---|---|---|---|---|---|---|---|---|

| 1 | 1,776 | 0 | 1,260 | 1,260 | 462 | 0 | 0 | 180 |

| ID | Built As | Square Ft | Year Built | Stories | Length | Width |

|---|---|---|---|---|---|---|

| 1.00 | Ranch 1 Story | 1,776 | 1995 | 1 | 0 | 0 |

| ID | Detail Type | Description | Units |

|---|---|---|---|

| 1 | Add On | Fireplace Gas | 1.00 |

| 1 | Basement | Finished | 1260.00 |

| 1 | Basement | Total Basement SF | 1260.00 |

| 1 | Fixture | Full Bath | 3.00 |

| 1 | Garage | Attached | 462.00 |

| 1 | Porch | Open Slab | 180.00 |

| 1 | Porch | Slab Roof Ceil | 78.00 |

| Account | Parcel | Account Type | Tax Year | Buildings | Actual Value | Local Govt Assessed Value | School Assessed Value |

|---|---|---|---|---|---|---|---|

| R0223695 | 070736311001 | Residential | 2025 | 1 | 478,081 | 29,880 | 33,700 |

| Type | Code | Description | Actual Value | Local Govt Assessed Value | School Assessed Value | Acres | Land SqFt |

|---|---|---|---|---|---|---|---|

| Improvement | 1212 | SINGLE FAMILY RESIDENTIAL IMPROVEMENTS | 413,081 | 25,820 | 29,120 | 0.000 | 0 |

| Land | 1112 | SINGLE FAMILY RESIDENTIAL-LAND | 65,000 | 4,060 | 4,580 | 0.077 | 3,375 |

| Totals | - | - | 478,081 | 29,880 | 33,700 | 0.077 | 3,375 |

Comparable sales for your Residential or Commercial property may be found using our SALES SEARCH TOOL

Values are updated annually on May 1st for Real Property and June 15th for Personal Property and Oil and Gas.

| Account | Parcel | Account Type | Tax Year | Buildings | Actual Value | Local Govt Assessed Value | School Assessed Value |

|---|---|---|---|---|---|---|---|

| R0223695 | 070736311001 | Residential | 2025 | 1 | 478,081 | 29,880 | 33,700 |

| Tax Area | District ID | District Name | Local Govt Mill Levy |

School Mill Levy |

Estimated Taxes |

|---|---|---|---|---|---|

| 5059 | 0700 | AIMS JUNIOR COLLEGE | 6.305 | 0.000 | $188.39 |

| 5059 | 0911 | EATON AREA PARK AND RECREATION DISTRICT | 5.626 | 0.000 | $168.10 |

| 5059 | 0505 | EATON FIRE | 9.000 | 0.000 | $268.92 |

| 5059 | 0403 | EATON TOWN | 5.446 | 0.000 | $162.73 |

| 5059 | 1050 | HIGH PLAINS LIBRARY | 3.179 | 0.000 | $94.99 |

| 5059 | 0301 | NORTHERN COLORADO WATER (NCW) | 1.000 | 0.000 | $29.88 |

| 5059 | 0202 | SCHOOL DIST RE2-EATON | 0.000 | 36.832 | $1,241.24 |

| 5059 | 0100 | WELD COUNTY | 15.956 | 0.000 | $476.77 |

| Total | - | - | 46.512 | 36.832 | $2,631.02 |

The estimate of tax is based on the prior year mill levy and the 2025 projected assessment rates. Mill levies and tax estimates will be updated yearly on December 22nd for the current year. Additional information can be found at https://assessor.weld.gov