Account: R8955579

July 4, 2025

| Account | Parcel | Account Type | Tax Year | Buildings | Actual Value | Local Govt Assessed Value | School Assessed Value |

|---|---|---|---|---|---|---|---|

| R8955579 | 131302200084 | Exempt | 2025 | 1 | 6,309,109 | 1,703,460 | 1,703,460 |

| Legal |

|---|

| PT NW4 2-2-68 LOT A REC EXEMPT RECX12-0023 EXC BEG CENTER 4 COR TH N00D34E 30 N89D57W 831.91 TH ALG NON-TANG CRV CONCAVE TO SOUTH (R=825 CH= N80D23W) TH NW ALG CRV 275.13 N89D57W 206.44 S00D21W 75.55 S00D21W 32.92 TO BEG NON-TANG CRV CONCAVE TO NORTH (R=410.37 CH=S76D55E) TH SE ALG CRV 237.99 N86D19E 731.39 N86.32E 138.58 S89D57E 211.63 N00D34E 30 TPOB |

| Subdivision | Block | Lot | Land Economic Area |

|---|---|---|---|

| FIRESTONE RURAL |

| Property Address | Property City | Section | Township | Range |

|---|---|---|---|---|

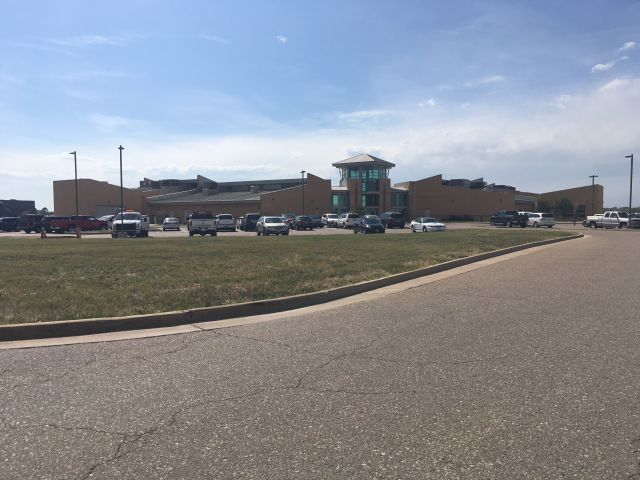

| 4209 COUNTY ROAD 24 1/2 | 02 | 02 | 68 |

| Account | Parcel | Account Type | Tax Year | Buildings | Actual Value | Local Govt Assessed Value | School Assessed Value |

|---|---|---|---|---|---|---|---|

| R8955579 | 131302200084 | Exempt | 2025 | 1 | 6,309,109 | 1,703,460 | 1,703,460 |

| Account | Owner Name | Address |

|---|---|---|

| R8955579 | WELD COUNTY | 1150 O ST GREELEY, CO 806319596 |

| Account | Parcel | Account Type | Tax Year | Buildings | Actual Value | Local Govt Assessed Value | School Assessed Value |

|---|---|---|---|---|---|---|---|

| R8955579 | 131302200084 | Exempt | 2025 | 1 | 6,309,109 | 1,703,460 | 1,703,460 |

No documents found.

| Account | Parcel | Account Type | Tax Year | Buildings | Actual Value | Local Govt Assessed Value | School Assessed Value |

|---|---|---|---|---|---|---|---|

| R8955579 | 131302200084 | Exempt | 2025 | 1 | 6,309,109 | 1,703,460 | 1,703,460 |

Building 1

| AccountNo | Building ID | Occupancy |

|---|---|---|

| R8955579 | 1 | Government Building |

| ID | Type | NBHD | Occupancy | % Complete | Bedrooms | Baths |

|---|---|---|---|---|---|---|

| 1 | Commercial | 3917 | Government Building | 100 | 0 | 0.00 |

| ID | Exterior | Roof Cover | Interior | HVAC | Perimeter | Units | Unit Type | Make |

|---|---|---|---|---|---|---|---|---|

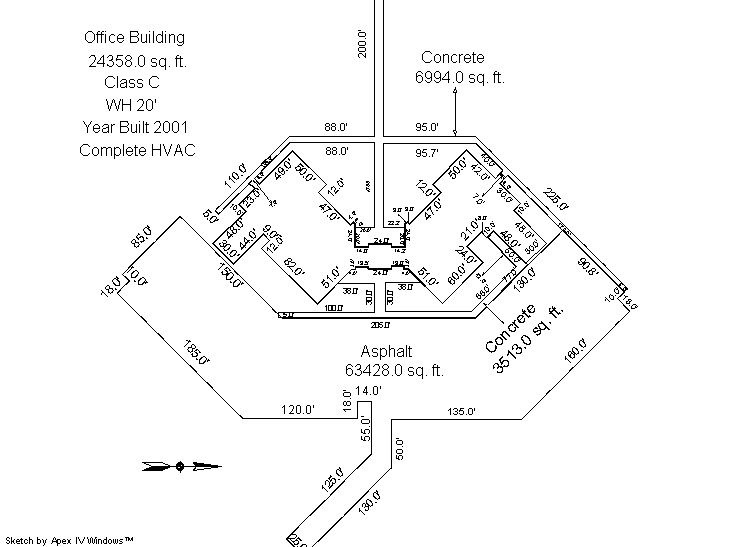

| 1 | NA | NA | NA | Complete HVAC | 1193 | 0 | NA | NA |

| ID | Square Ft | Condo SF | Total Basement SF | Finished Basement SF | Garage SF | Carport SF | Balcony SF | Porch SF |

|---|---|---|---|---|---|---|---|---|

| 1 | 23,630 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| ID | Built As | Square Ft | Year Built | Stories | Length | Width |

|---|---|---|---|---|---|---|

| 1.00 | Government Building | 23,630 | 2001 | 1 | 0 | 0 |

| ID | Detail Type | Description | Units |

|---|---|---|---|

| 1 | Add On | Asphalt Average | 63428.00 |

| 1 | Add On | Concrete Slab Average | 10507.00 |

| Account | Parcel | Account Type | Tax Year | Buildings | Actual Value | Local Govt Assessed Value | School Assessed Value |

|---|---|---|---|---|---|---|---|

| R8955579 | 131302200084 | Exempt | 2025 | 1 | 6,309,109 | 1,703,460 | 1,703,460 |

| Type | Code | Description | Actual Value | Local Govt Assessed Value | School Assessed Value | Acres | Land SqFt |

|---|---|---|---|---|---|---|---|

| Improvement | 9239 | EXEMPT-COUNTY NON RESIDENTIAL IMPS | 5,400,126 | 1,458,030 | 1,458,030 | 0.000 | 0 |

| Land | 9139 | EXEMPT-COUNTY NON RESIDENTIAL LAND | 908,983 | 245,430 | 245,430 | 35.376 | 1,540,979 |

| Totals | - | - | 6,309,109 | 1,703,460 | 1,703,460 | 35.376 | 1,540,979 |

Comparable sales for your Residential or Commercial property may be found using our SALES SEARCH TOOL

Values are updated annually on May 1st for Real Property and June 15th for Personal Property and Oil and Gas.

| Account | Parcel | Account Type | Tax Year | Buildings | Actual Value | Local Govt Assessed Value | School Assessed Value |

|---|---|---|---|---|---|---|---|

| R8955579 | 131302200084 | Exempt | 2025 | 1 | 6,309,109 | 1,703,460 | 1,703,460 |

| Tax Area | District ID | District Name | Local Govt Mill Levy |

School Mill Levy |

Estimated Taxes |

|---|---|---|---|---|---|

| 6115 | 0302 | CENTRAL COLORADO WATER (CCW) | 1.017 | 0.000 | $1,732.42 |

| 6115 | 0309 | CENTRAL COLORADO WATER SUBDISTRICT (CCS) | 1.507 | 0.000 | $2,567.11 |

| 6115 | 0305 | CENTRAL WELD COUNTY WATER (CWC) | 0.000 | 0.000 | $0.00 |

| 6115 | 1050 | HIGH PLAINS LIBRARY | 3.179 | 0.000 | $5,415.30 |

| 6115 | 1202 | LONGMONT CONSERVATION | 0.000 | 0.000 | $0.00 |

| 6115 | 0512 | MOUNTAIN VIEW FIRE PROTECTION DISTRICT | 16.247 | 0.000 | $27,676.11 |

| 6115 | 0301 | NORTHERN COLORADO WATER (NCW) | 1.000 | 0.000 | $1,703.46 |

| 6115 | 0213 | SCHOOL DIST RE1J-LONGMONT | 0.000 | 57.168 | $97,383.40 |

| 6115 | 0303 | ST VRAIN LEFT HAND WATER (SVW) | 1.406 | 0.000 | $2,395.06 |

| 6115 | 0620 | ST VRAIN SANITATION | 0.316 | 0.000 | $538.29 |

| 6115 | 0100 | WELD COUNTY | 15.956 | 0.000 | $27,180.41 |

| Total | - | - | 40.628 | 57.168 | $166,591.57 |

The estimate of tax is based on the prior year mill levy and the 2025 projected assessment rates. Mill levies and tax estimates will be updated yearly on December 22nd for the current year. Additional information can be found at https://assessor.weld.gov